The first step towards a better financial quality of life is knowing where you stand. Take this quiz to see your financial health score.

This article references the financial health study: U.S. Financial Health Pulse 2024 Trends Report by the Financial Health Network. Review the full report here.

After you’ve taken the quiz, read on to learn more about your score and discover free resources to empower your financial life. Or, just read on to learn how everyone else is doing in the realm of good financial health.😉

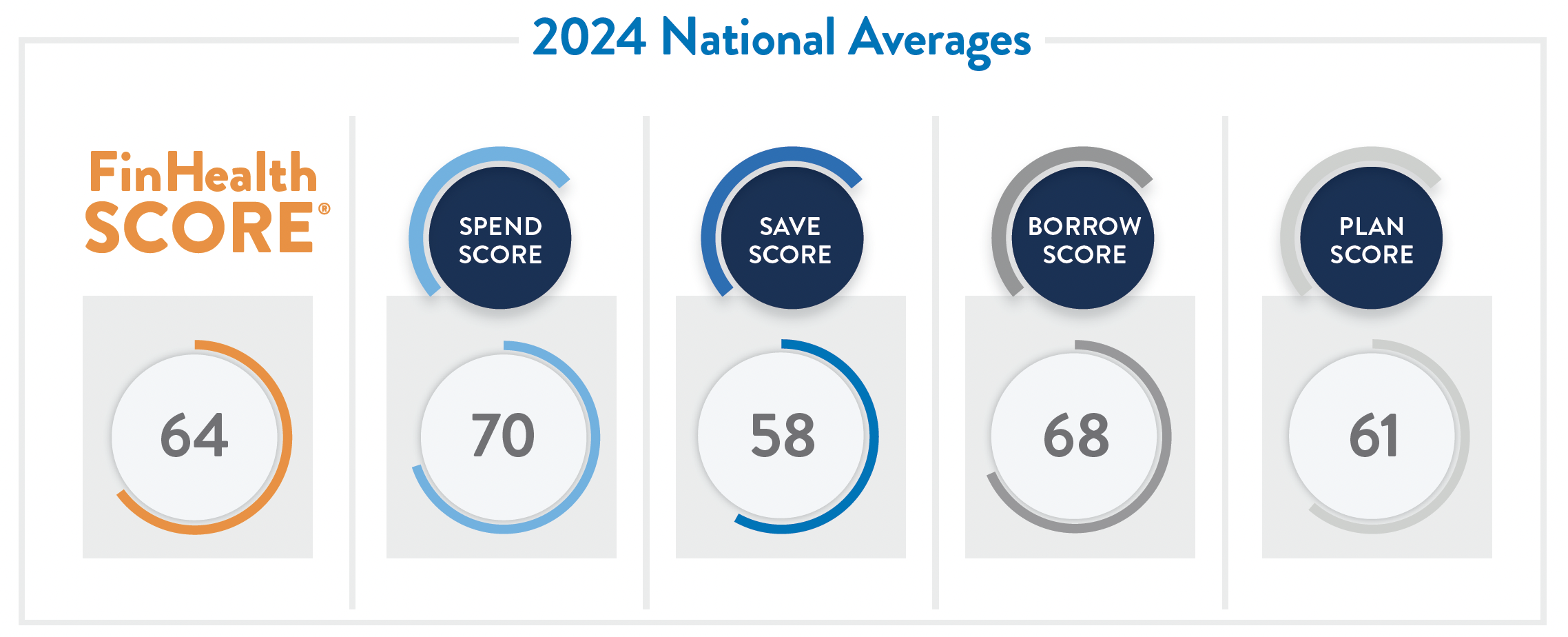

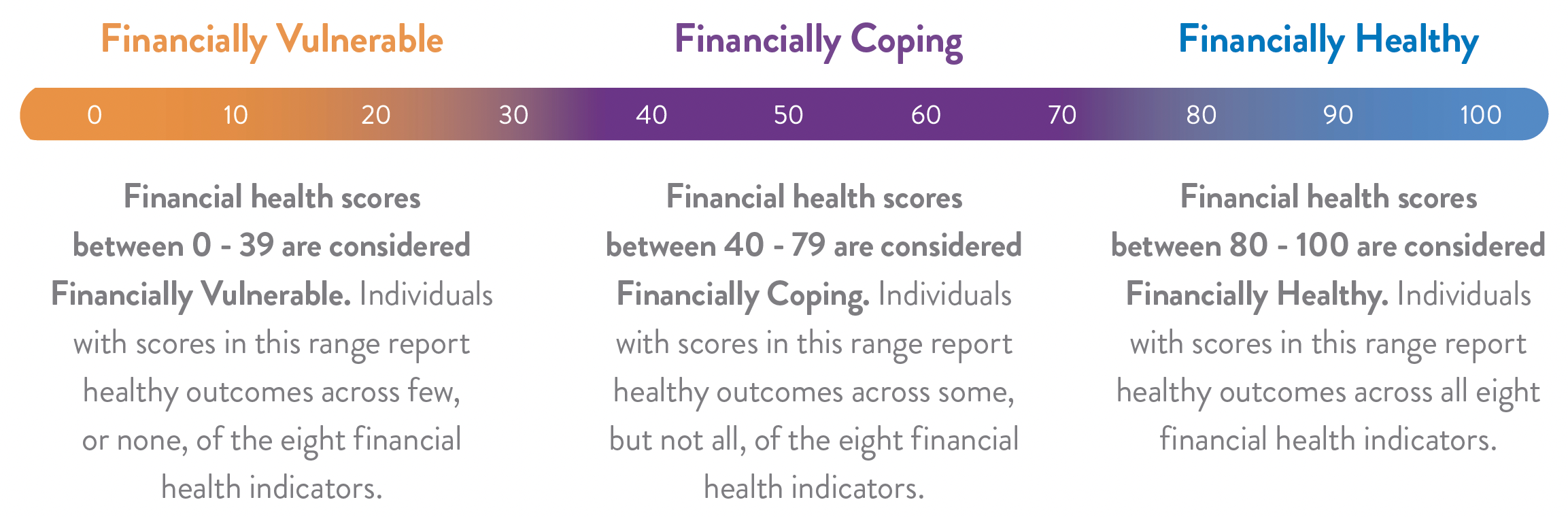

How Americans' Financial Health Is Right Now

What Do These Indicate?

The Eight Financial Health Indicators

These four behaviors - Spend, Save, Borrow, Plan - and how you answer questions related to them, determine your financial health score.

Take a look at each of the eight indicators, explained below. Find the ones where you may have room for growth. Then, take a look at the free resources we offer to help get you on your way to the good (or better) financial health score that you'd like to see!

Financial Health Indicator #1: Spend Less Than Income

Easier said than done, this indicator asks whether you have a positive or negative cash flow.

Cash flow is the relationship between the amount of money coming in to the household and the amount of money spent.

Negative Cash Flow Example

If the Smith family earns $6,000 monthly, and their monthly spending is $6,500, this would be considered a negative cash flow. They are spending more than their income on a monthly basis, which indicates they're probably going a little further into debt (or eating up their savings) every month.

Positive Cash Flow Example

Alternatively, if the Smith family were able to make more money, or spend less, or both - this could lead to a positive cash flow. Let's say the main breadwinner gets a promotion at work and now makes $6,500 per month, and they're able to cut some of their expenses down to $5,800 per month. Now the Smiths have a positive cash flow ($700 extra!) each month. This is a positive indicator for financial health because of the flexibility it gives them. That extra money can be saved, used to pay off debt, or put aside for an emergency.

Free Resources:

- Enrich Financial Wellness Program

- Free Guide to Budgeting Tips and Tricks: Quick solutions to start saving today

- Budget Calculator

Financial Health Indicator #2: Pay Bills On Time

Paying your bills on time has a big effect on your credit score, and is an indicator of whether you have enough money to pay your bills on a regular basis. On-time payment history shows that you're likely to be able to keep paying your bills in the future.

Some lenders, creditors, and companies have a grace period from the due date (a few days, usually) where you don't get charged a fee or extra interest if you're a little late making your payment.

And although every creditor is a little different regarding what they consider a 'late' payment, it's officially considered 'late' after 30 days of no payment after the due date. At this point, it can be sent to collections and reported to the credit bureaus.

One thing you can do if you find that you're unable to make a payment by the due date on any given month is call the creditor and have a conversation. Explain the situation and see if the due date can be moved or if you can make a partial payment. This open line of communication shows that you care - and they'll more than likely make accommodations to help.

Free Resources:

- Enrich Financial Wellness Program

- Budget Organizer

- Visit our Bill Pay page and learn how to set up free automatic bill pay service through online banking.

- Ellafi Says Blog Articles

Financial Health Indicators #3 and #4: Savings Habits

Liquid Savings

Liquid Savings means that the your money can be accessed at any time - they're not locked away in a CD or IRA, they're just in a savings account if needed. Here are a few reasons people put away money in savings:

- Emergency Fund

Depending on your situation, it's recommended to have between 3-12 months of living expenses saved up in case of an emergency such as income loss, hospitalization, or other. Living expenses should include, but are not limited to, costs of housing, utilities, food, and transportation.

- Goal Savings

Savings up for the things you want or need, or know are coming up, is always a good idea! Some things folks save up for include: holidays, vacations, home improvement, and down payments for large purchases such as cars or homes.

Free Resources:

Have Long-Term Savings

On the other hand, your long-term savings funds may be tied up in retirement accounts or other long term investment accounts. This is ok! Having long-term savings shows that you're looking towards the future and planning for it, not waiting for that lucky lottery ticket or family member's estate to set you up for retirement.

Free Resources:

Financial Health Indicator #5: Have Manageable Debt

How much debt is too much? Experts recommend that you spend no more than 28% of your monthly income on housing (rent/mortgage, insurance/taxes/fees) and no more than 36% on all debt payments.

DTI Percentage Example

1. Add up gross monthly income for your household

Jamie took his Gross Annual Income from his W2 and divided it by 12 to get his gross monthly income amount: $4,350

2. Add up all monthly minimum debt payments

Jamie found the total of all his monthly minimums on debt (mortgage, car payment, credit card minimum payment, student loan minimum payment): $1,700

3. Divide the debt by the income and you’ll get a decimal/percentage

Debt ($1,700) divided by Income ($4,350) = 0.39 or 39%

Jamie is slightly over the recommended 35% so he may want to check out some of our free resources on managing debt.

Free Resources:

Financial Health Indicator #6: Have a Prime Credit Score

Borrowers - and loans - tend to fit into two categories: Prime or Subprime.

Prime borrowers are likely to get approved for the best loan types, rates, and terms. According to the CFPB, prime credit falls within the range of 660 to 719, but these numbers can vary a little bit depending on lender and organization.

Then you have your 'super' prime which is high 700s up to 850. Your credit score is determined by a number of factors, and it can be improved in as little as 6-12 months. It's worth learning more about to improve it or keep it in the prime range. We offer our members free daily score updates and monitoring within online banking. It does not hurt your score to check!

Free Resources

Financial Health Indicator #7: Have Appropriate Insurance

“Appropriate insurance” looks different for everyone. There are many different kinds of insurance, and although everybody needs some types of insurance, not everyone needs all types of insurance. Here’s a list of the major ones:

- Health/Medical Insurance

- Auto Insurance

- Homeowners or Renters Insurance

- Life Insurance

- Disability Insurance

- Long-Term Care Insurance

- Identity Theft Protection Insurance

- Umbrella Coverage Insurance

Obtaining insurance means that you are able to plan for the unforeseen. Looking ahead to all the possible ‘what if’ scenarios.

Free Resources:

Financial Health Indicator #8: Plan Ahead Financially

This financial health indicator simply assesses whether individuals are looking ahead financially or not. If you are making your last $10 stretch until next week, it’s going to be a lot harder to look ahead financially to next year, or 10 years from now, because that’s too overwhelming.

This indicator shows whether an individual has the capacity to plan for the future.

Free Resources:

Conclusion

Learning your current financial health score is a courageous step. Reading about the indicators and gathering resources to help is even more so! We hope this resource has been helpful and that you're on your way to boosting your score and your financial well being. And, as always, know that Ellafi Federal Credit Union is here to help. If you're ready to become a member, click the button below to open your membership savings account - only $5 required.

This program leverages the Financial Health Network FinHealth Score® Toolkit. This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.